Just like the north star after which we are named, we are here to help you guide your portfolio safely to your financial destination.

Our Three Core Principles

At Polaris Financial Group, everything we do is thoughtfully designed around our three core principles: loss avoidance, loss avoidance & loss avoidance.

Primum non nocere

When it comes to investing, your first goal should be to first, do no harm (Primum non nocere). Warren Buffett once said, “The first rule of an investment is don't lose [money]. And the second rule of investing is don't forget the first rule. As your losses increase, it becomes geometrically more difficult to recover. Philosophically, it is better to forego the highest returns in exchange for a guarantee of zero losses. These are the kinds of investments that we specialize in.

We take our advisory role seriously and we will always strive to offer you the best advice possible. We understand that the most important consideration is not your return on principal but rather the return of your principal.

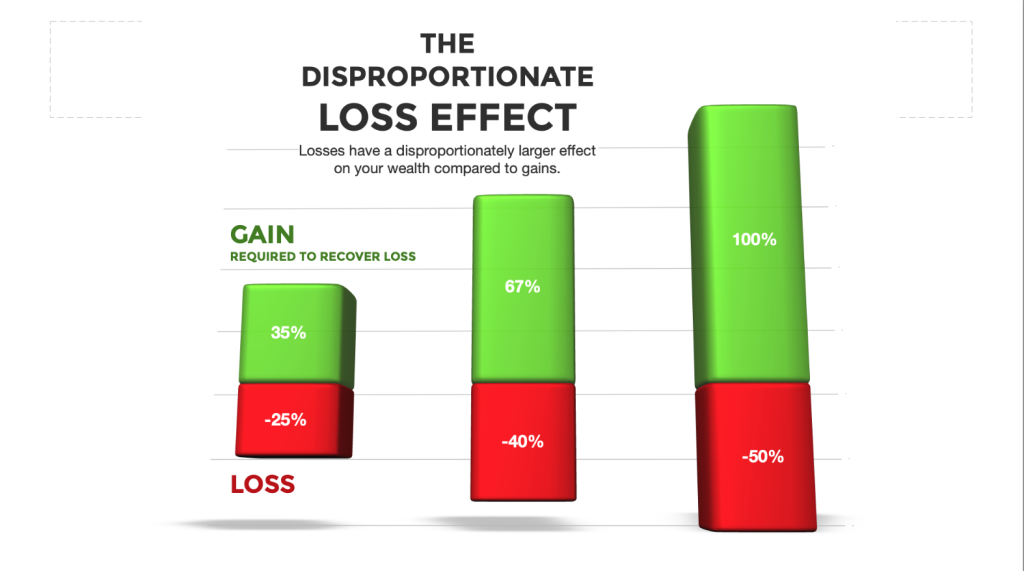

Avoiding losses is the primary focus of our investment strategy. The chart below shows how the larger your loss, the more difficult it is to recoup your losses. In exchange for losing a bit of your upside potential, you can now purchase tax sheltered investments that can only go up when the market goes up but protect your principal if the market goes down. A win/win investment scenario for conservative investors.

Losses have a bigger effect on your wealth in terms of real dollars than the same percentage gain has.

This is why negative returns are so bad. Because the larger the losses, the more difficult it is to get back to even.

Once You Have a Good Grasp on Your Risk Profile,

the Next Step is to Focus on Your Retirement Income Needs

We Can Show You How to Retire Income Tax-Free!

Our official federal debt is approximately 30 trillion dollars, which is a phenomenally large number. The worst part is that when you add "off the books" liabilities, which is to say you include all of the money our government has promised to pay the number rises to an astronomical 123 trillion dollars. This is money that will have to be repaid and the way the government will raise the money is by dramatically raising tax rates. As tax rates rise your retirement income that is subject to taxation will be greatly diminished. It is incumbent on you to have as much of your retirement income come from tax-free sources. We can help you maximize your tax-free post-retirement income such that you won't have to worry about rising income tax rates.

Basically, you have three buckets of money. 1)Taxable, things like money market accounts, investment accounts, CD's, and any other taxable investments. 2) Tax-deferred accounts. Things like IRA's, 401-ks, 403bs, and other accounts that are taxed when the funds are distributed. 3) Tax-free accounts. This includes Roth IRAs, life insurance, and income-producing real estate.

The basic idea is that you want as much of your income in retirement to come from your tax-free buckets. So, the foundation of your retirement plan should be your Roth IRA and your Index Universal Life policy.

Our primary focus is on guaranteed accounts like indexed annuities and indexed universal life. Ideally, you would use indexed annuities in your Roth IRA and you would use an Indexed Universal Life insurance policy as a kind of private, tax-free retirement program. The benefit of Indexed Annuities and Indexed Universal Life is that while they both allow you to potentially earn double digit returns they allow you to do so while having zero downside risk. While there are some tradeoffs, on balance Indexed Annuities and Indexed Universal Life policies have a place in most investor's portfolios.

Life insurance is the only thing in the tax code that allows you to grow your money tax-free and withdraw it tax-free in the form of policy loans. The combination of Roth Ira's and Indexed Universal Life is the ideal combination to achieve a zero income tax retirement.

Click here to learn more about retirement planning.

Blog

Now is the Time to Convert to a Roth IRA

If you have tax-deferred accounts, now is the time to convert them (or begin converting them) to a Roth IRA. As we are now in the midst of a Bear Market, odds are the many of your stock holdings are now off a bit from their highs. This article in the Wall St. Journal argues…

Living Benefits of Indexed Universal Life Insurance

One of the primary benefits of an Indexed Universal Life insurance policy (IUL) is that in addition to paying a death benefit to your heirs in the event you should die, it also will provide you with living benefits in the event you should get a critical, chronic or terminal illness. While the specifics will…

The Value of Converting You IRA to a Roth IRA (Video)

I made this video for a potential client showing the benefit of converting an IRA to a Roth IRA and adding an Index Universal Life Policy. I have this video elsewhere on the site but I thought I’d add it here as well. Check it out below:

You Have No Say in How Your Assets Get Distributed

OK, here in the United States you still have the ability to determine where your assets go, but in France, all children of the decedent must get a share of the estate. The hell you say. I am not giving my ungrateful child a penny. Well, according to this article “While freedom of testation and…

The Easy Way to Get More Tax-Free Income (Video)

The federal deficit is out of control. The bottom line is that income tax rates are going to rise, dramatically. What can you do about this. I made a video giving you the best strategy to achieve a tax free retirement income. Check it out.

Why Your Retirement Plan Projections May Not be Worth the Paper their Written On

This article basically makes the case that the economy is teetering between high-interest rates and a recession. “In the case of the Fed and the ECB, the tight corner to negotiate is extremely high inflation. It was still 8.3% in April 2022. A 40-year high in America. The situation is not much better in Europe:…

A Freight Train Is Coming Your Way

Sometimes it’s easier to avoid uncomfortable realities and hope that the bad thing never happens. Before we go any further, I want you to take 10 seconds of your time and click on this link. It shows that our national debt is over 30 trillion. Needless to say, a trillion is a lot of money.…

- « Previous

- 1

- 2

Contact Us

IMPORTANT DISCLAIMER: This information is not intended to provide legal or tax advice. Before making any financial decisions, you are strongly advised to consult with proper legal or tax professionals to determine the tax consequences in your financial situation.