Now is the Time to Convert to a Roth IRA

If you have tax-deferred accounts, now is the time to convert them (or begin converting them) to a Roth IRA. As we are now in the midst of a Bear Market, odds are the many of your stock holdings are now off a bit from their highs. This article in the Wall St. Journal argues that “Roth IRAs are the best retirement plans to have, and this year’s market declines have put them on sale”.

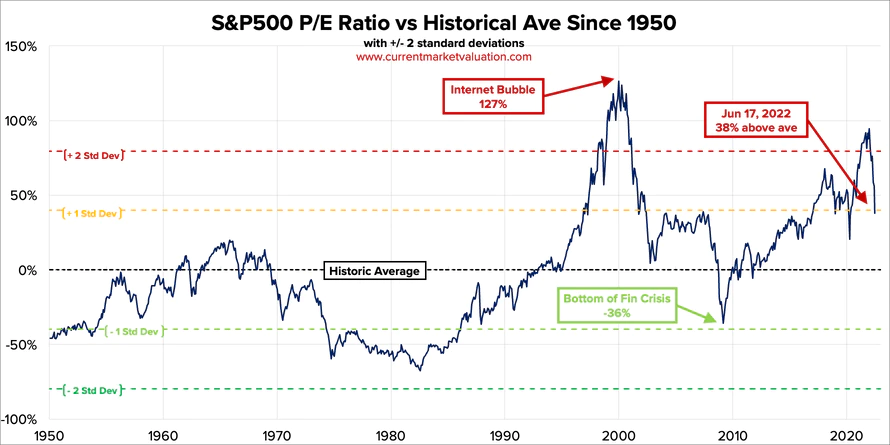

Thing is is that if things are on sale now, there is, in my opinion a very good chance that the market is going to go substantially lower than it already has based on historical evidence.

In the stock market the Price to Earnings ratio (P/E) is the measure of a stocks value indication the relationship between a stock’s price and the annual earnings per share of the company. In the modern era the average P/E ratio has been 19.6. Even after the recent decline in the market, the current P/E ratio of the S&P 500 is 27.7 as of 6/17/22. By this metric the market is still 38% overvalued and during corrections markets tend to go from overvalued to undervalued which suggests that there is much further to go on the downside.

Courtesy of https://www.currentmarketvaluation.com/models/price-earnings.php

So, given the tax advantages of converting to a Roth IRA and the good possibility of a significant further downside, now is the time to do your Roth IRA conversions. I have a couple of videos in other blog posts showing the advantages of converting to a Roth IRA and adding an Indexed Universal Life Insurance Policy to your estate. Check out the posts with video in the heading here: https://polarisfinancialgroup.com/posts/