Why Your Retirement Plan Projections May Not be Worth the Paper their Written On

This article basically makes the case that the economy is teetering between high-interest rates and a recession.

“In the case of the Fed and the ECB, the tight corner to negotiate is extremely high inflation. It was still 8.3% in April 2022. A 40-year high in America. The situation is not much better in Europe: 7.5% in April 2022. The central bankers must therefore slow down their ultra-accommodating monetary policies to move towards a tightening cycle.”

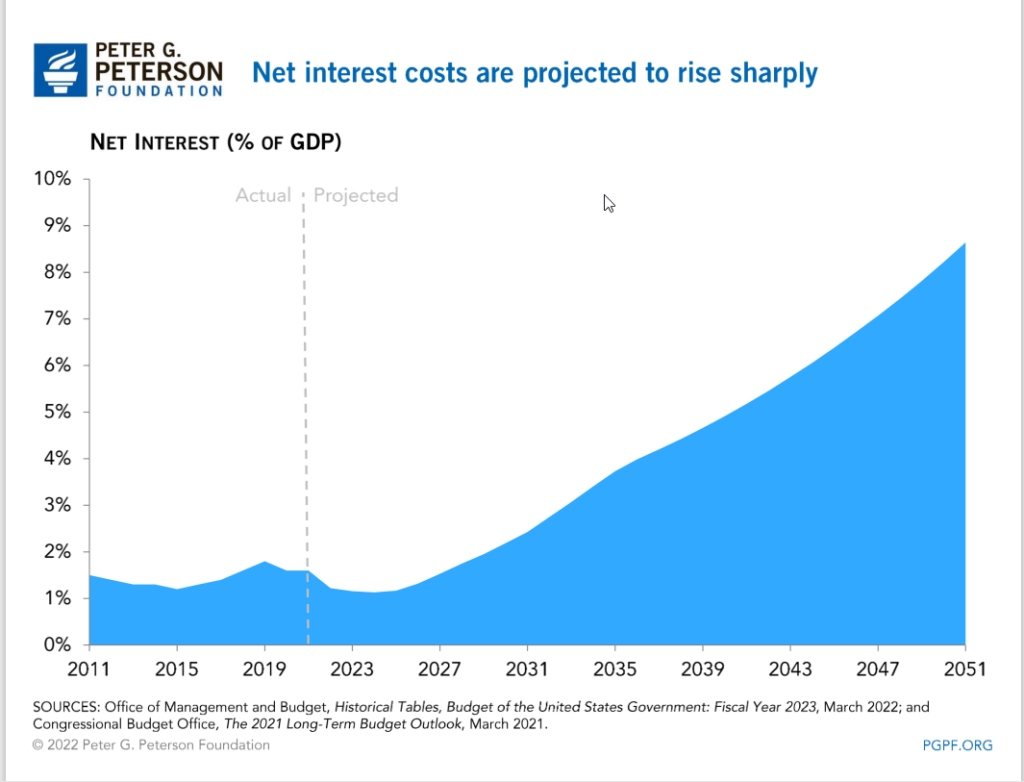

The bottom line is that the Fed needs to battle inflation by continuing to raise interest rates, possibly causing a recession. Given the disastrous effects that higher interest rates have on our national debt service, the Fed is literally between a rock and a hard place. If they don’t raise interest rates inflation will likely continue unabated or, heaven forbid, get even worse. If they do raise rates, which they have stated they will, then the cost to service our trillions in debt (read more about our federal debt here) will balloon.

No matter what, the odds of us seeing 2% real inflation again any time soon are highly unlikely.

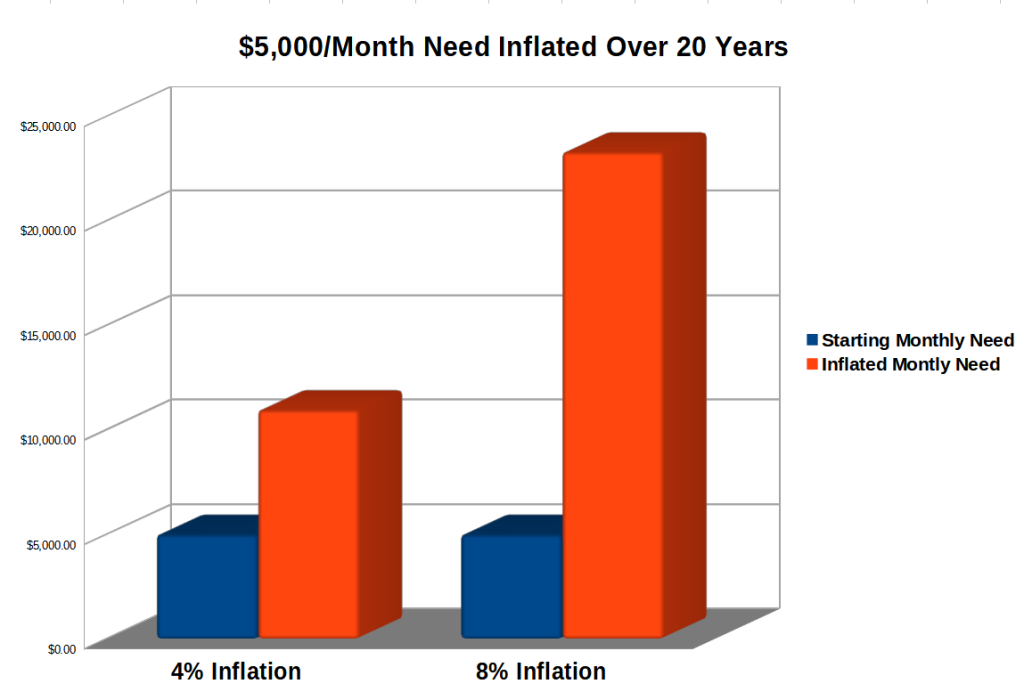

Thing is that pretty much every retirement plan created in the last year (or earlier) is almost certainly estimating your future inflation rate at anywhere from 2% to 4%. With official inflation coming in at over 8% and the prospects of it continuing at current levels or close to them seems to be very high.

The difference between a 4% and an 8% compounded inflation rate is dramatic. For example, at a 4% inflation rate, your need for a $5000 monthly benefit will grow to $10,957 a month. So, at 4% inflation for 20 years your monthly needs will basically double.

At 8% your $5000 monthly need will explode to $23,304 per month! More than a 400% increase and over 2x what you would need with a 4% interest rate.

The Real Inflation Rate

Now, one question to ask is what is the real inflation rate. If you are going to try to make projections, you can use the official inflation number, which is currently around 8% or you can consider alternate ways of calculating inflation. This website calculates inflation the way it was calculated before it was changed, for political reasons, in the 1980s and again in the 1990s. According to the way things were actually calculated then, the current inflation rate is between 12%-15%+!

In the charts above we show two SGS-Alternate CPI estimates: One based on the pre-1990 official methodology for computing the CPI-U, and the other based on the methodology which was employed prior to 1980.

The fact is that inflation was at or near 2% for a very long time and it was easy to assume that things would stay that way, for a while at least. This is why it’s almost certain that you assumed a 2%-4% inflation rate in your retirement plan calculations. Almost nobody expected inflation to appear as quickly and viciously as it has.

What really matters is not the “official” inflation rates but rather how much your personal expenses are subject to inflation. If we look at how inflation was calculated based on the pre-1980 official methodology and based on the methodology which was employed prior to 1990 we see dramatically higher inflation rates than the current official numbers.

We know that the change to the way that inflation was calculated was done for political reasons and not economic ones. So, which numbers do you think are more accurate, the way they were calculated in the 80s and 90s, or how they are calculated today.

Which number should you use for inflation in your financial plan? Prudence would suggest using the largest reasonable number that makes sense to you. Given the two charts above, it would seem prudent to use numbers significantly higher than the 2%-4% numbers that you most likely used in your most recent financial plan.

Of course, the odds of inflation staying at 8% every year for the next 20 years is highly unlikely but it’s also very possible that real inflation may get much higher than 8% and stay that way for many years. Even if we don’t see 20 years of 8% inflation, what if we see 5 years of 15%+ inflation? The current 8%+ inflation is the official inflation rate. In reality, it’s probably much higher. Do you trust the government?

Point is that if you had a retirement plan done with any kind of what was considered “realistic” projections for inflation, you need to take a serious look at your assumptions and adjust accordingly.