Just like the north star after which we are named, we are here to help you guide your portfolio safely to your financial destination.

Our Three Core Principles

At Polaris Financial Group, everything we do is thoughtfully designed around our three core principles: loss avoidance, loss avoidance & loss avoidance.

Primum non nocere

When it comes to investing, your first goal should be to first, do no harm (Primum non nocere). Warren Buffett once said, “The first rule of an investment is don't lose [money]. And the second rule of investing is don't forget the first rule. As your losses increase, it becomes geometrically more difficult to recover. Philosophically, it is better to forego the highest returns in exchange for a guarantee of zero losses. These are the kinds of investments that we specialize in.

We take our advisory role seriously and we will always strive to offer you the best advice possible. We understand that the most important consideration is not your return on principal but rather the return of your principal.

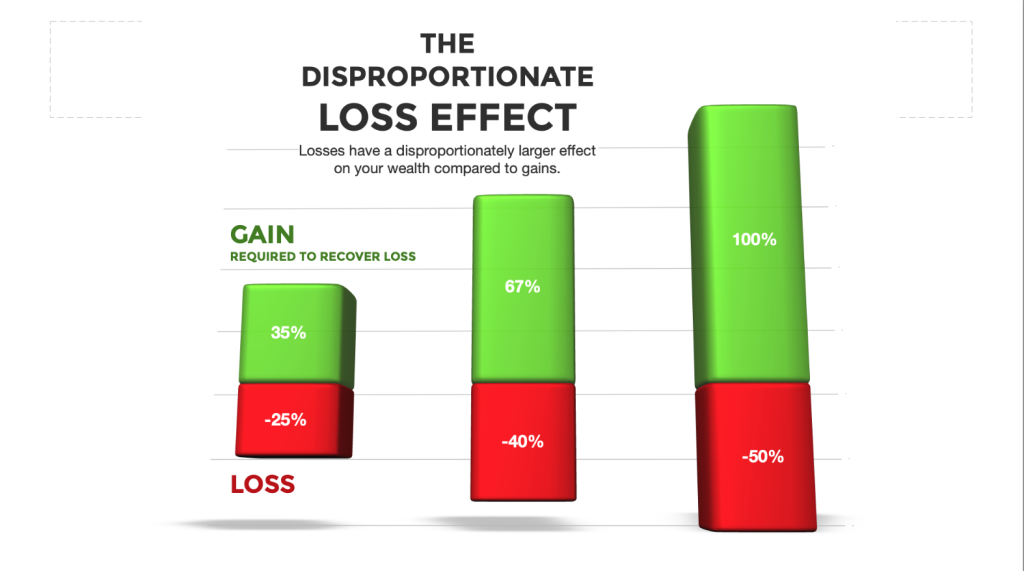

Avoiding losses is the primary focus of our investment strategy. The chart below shows how the larger your loss, the more difficult it is to recoup your losses. In exchange for losing a bit of your upside potential, you can now purchase tax sheltered investments that can only go up when the market goes up but protect your principal if the market goes down. A win/win investment scenario for conservative investors.

Losses have a bigger effect on your wealth in terms of real dollars than the same percentage gain has.

This is why negative returns are so bad. Because the larger the losses, the more difficult it is to get back to even.

Once You Have a Good Grasp on Your Risk Profile,

the Next Step is to Focus on Your Retirement Income Needs

We Can Show You How to Retire Income Tax-Free!

Our official federal debt is approximately 30 trillion dollars, which is a phenomenally large number. The worst part is that when you add "off the books" liabilities, which is to say you include all of the money our government has promised to pay the number rises to an astronomical 123 trillion dollars. This is money that will have to be repaid and the way the government will raise the money is by dramatically raising tax rates. As tax rates rise your retirement income that is subject to taxation will be greatly diminished. It is incumbent on you to have as much of your retirement income come from tax-free sources. We can help you maximize your tax-free post-retirement income such that you won't have to worry about rising income tax rates.

Basically, you have three buckets of money. 1)Taxable, things like money market accounts, investment accounts, CD's, and any other taxable investments. 2) Tax-deferred accounts. Things like IRA's, 401-ks, 403bs, and other accounts that are taxed when the funds are distributed. 3) Tax-free accounts. This includes Roth IRAs, life insurance, and income-producing real estate.

The basic idea is that you want as much of your income in retirement to come from your tax-free buckets. So, the foundation of your retirement plan should be your Roth IRA and your Index Universal Life policy.

Our primary focus is on guaranteed accounts like indexed annuities and indexed universal life. Ideally, you would use indexed annuities in your Roth IRA and you would use an Indexed Universal Life insurance policy as a kind of private, tax-free retirement program. The benefit of Indexed Annuities and Indexed Universal Life is that while they both allow you to potentially earn double digit returns they allow you to do so while having zero downside risk. While there are some tradeoffs, on balance Indexed Annuities and Indexed Universal Life policies have a place in most investor's portfolios.

Life insurance is the only thing in the tax code that allows you to grow your money tax-free and withdraw it tax-free in the form of policy loans. The combination of Roth Ira's and Indexed Universal Life is the ideal combination to achieve a zero income tax retirement.

Click here to learn more about retirement planning.

Blog

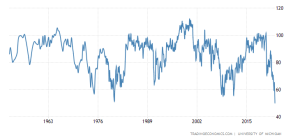

The gap between 2-year and 10-year Treasury yields is now the most inverted since 1981

The gap between 2-year and 10-year Treasury yields is now the most inverted since 1981:

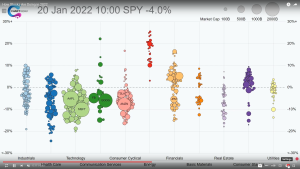

Bear Market Resumes

Despite the market having had a nice rebound this summer, the bear market rally fizzled as it broke above its 50-day exponential moving average. Long-term, we are still above the 200-day exponential moving average (EMA), but that too is within earshot. The SPY closed at 392.27 while the 200-day EMA is at 367.20. A drop…

Bull Market Continues…

This is a chart of the S&P 500 SPDR. Spider (SPDR) is a short form name for a Standard & Poor’s depository receipt, an exchange-traded fund (ETF) managed by State Street Global Advisors that tracks the Standard & Poor’s 500 index (S&P 500). The S&P 500 “is a stock market index tracking the stock performance…

Bear Market Rally?

All of the major market indices have rallied nicely off of the lows set in June. The question is whether this is the start of a new bull market or merely a bear market rally. Fundamentally, stock prices are all about earnings. As corporate earnings rise, stock prices usually follow. While corporate earnings and stock…

87,000 New Friends

The United States of America is bankrupt beyond our ability to grasp the enormity of the debt. To put it in perspective, as I mentioned in “A Freight Train is Coming Your Way” post, our current national debt is over 100 trillion dollars. If you use the 100 trillion dollar number, which is probably on…

How Far Down?

I calculated the historic average S&P 500 P/E ratio going back to 1871 using the data available on this website. The historic average P/E ratio is 15.98. The math is as follows: Current P/E Ratio = 20.58Historic Average (Going back to 1871) = 15.98Difference = 7.13Difference Divided By Average (7.13/15.98) = 44.62% So, by simple…

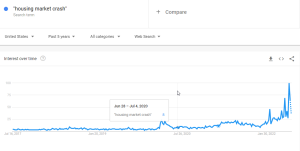

Why a Housing Market Crash is Coming

Most markets act like a pendulum. Prices go from undervalued to overvalued and back again to undervalued. They never stop at fairly valued. They can, however, remain undervalued or overvalued for years. We are now at what appears to be the tail end of biggest housing price boom ever. According to an article in Fortune…

Pay Now or Pay Later? (Video)

A big question amongst investors is whether it’s a good idea to pay your taxes in advance as you do with a Roth IRA or defer them as you do with a traditional IRA. Traditionally, the advice has been to defer taxes as you are expected to be in a lower tax bracket after retirement…

It’s a Market of Stocks (Video)

After what has been described as the worst first half of the year for stocks in a very long time, it’s time to assess the damage. There is an old saying that it’s not a stock market as much as it is a market of stocks. Of course, while this makes intuitive sense it can…

Why We are Heading for a Crash

If you read my last post you know that the stock market is still seriously overvalued. Well, it’s worse than that. The country’s gross domestic product (GDP) is the result of 4 components. Personal consumption expenditures, business investment, government spending and net export of goods and services. In 2019 70% of the US’s GDP was…

Contact Us

IMPORTANT DISCLAIMER: This information is not intended to provide legal or tax advice. Before making any financial decisions, you are strongly advised to consult with proper legal or tax professionals to determine the tax consequences in your financial situation.